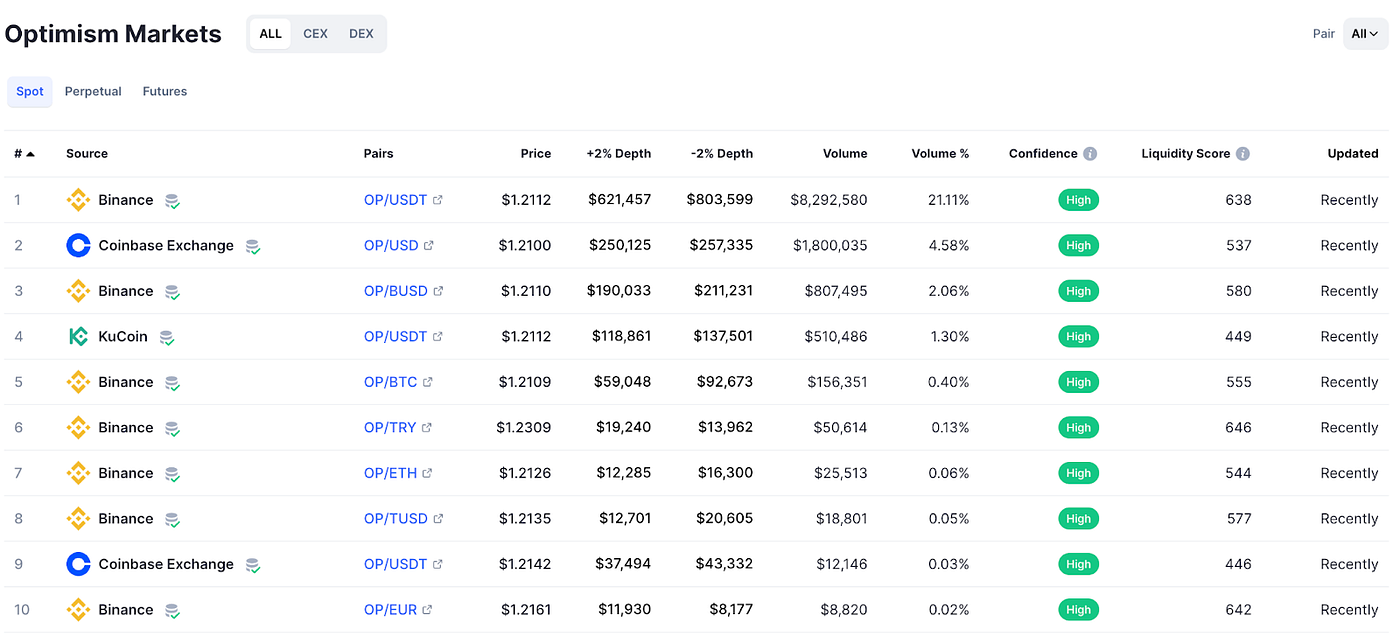

Upon observing the trading volume of Optimism, a layer 2 solution, it is evident that centralized exchanges (CEXs) exhibit higher trading volume than decentralized exchanges (DEXs). This is a paradox given that as the token issuer, Layer 1s, Layer 2s, and DeFi Protocols should ideally be able to provide deeper liquidity on DEXs residing on their own chain

As seen above, Binance is able to leverage some of its volume to grow its DeFi ecosystem both on it’s L1 (BSC) and its DEX (Pancake Swap), andwe believe other L1s and L2s can be a lot more focused on ensuring their token volume settles on chain.

Presently, Layer 1 and Layer 2 solutions and DeFi protocols conduct their token sales primarily on a myriad of CEXs, leading to a significant shortfall in on-chain activity. A fundamental shift in this modus operandi is necessary to stimulate the on-chain economy andtoken issuers should be adding requirements for settlement on their DEX or chain when setting up these token sales.

To address this, a key step would be migrating some of that trading activity from CEXs to on-chain exchanges. By doing so, we can stimulate a robust on-chain ecosystem, invigorate on-chain perpetual DEXs, and set in motion the domino effect of engaging more lending/borrowing activities within the on-chain context. In essence, the goal is to stimulate the on-chain ecosystem and trigger a cascade of active engagements, such as lending/borrowing and on-chain perpetual DEX trading, thereby fueling the on-chain economy.

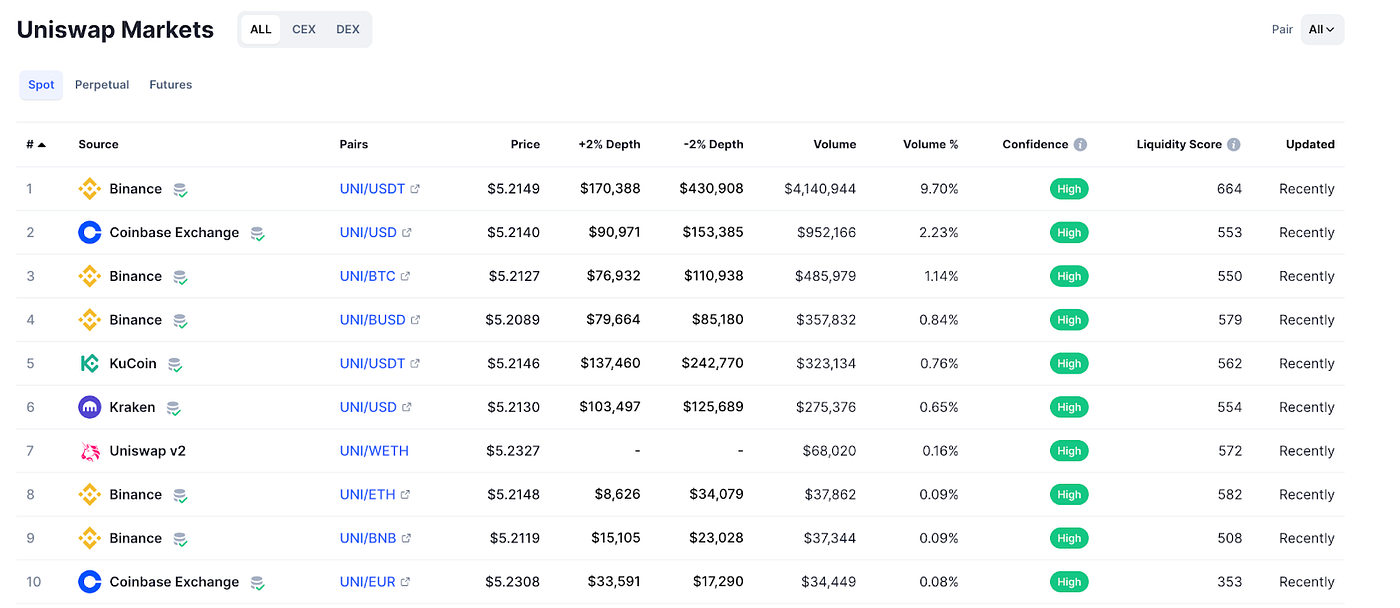

The current trading landscape presents a paradox, particularly when considering DEXs such as Uniswap. Despite Uniswap team’s efforts in creating one of the most sophisticated DEXs globally, the bulk of the volume for their own token primarily transacts on CEXs. Ironically, Uniswap v3 only ranks as the 10th most active platform for trading its own token.

In order to comprehend this phenomenon, it’s crucial to examine the competitive dynamics between DEX liquidity and CEXs. This understanding forms the foundation for strategizing incentivization mechanisms aimed at enhancing the attractiveness and efficiency of DEXs. The ultimate goal is to ensure that DEXs offer trade execution for various trade sizes that is as good as, if not better than, CEX execution.

There are a number of reasons why CEXs are out-competing DEXs:

- Liquidity and Slippage: CEXs often have higher liquidity and less price slippage due to larger user bases and order books. This results in more efficient markets and better trading experiences. DEXs and Layer 1/Layer 2 solutions should focus on incentivization strategies to attract more liquidity providers.

- User Experience and Usability: CEXs often provide a more user-friendly interface, which is crucial for new users who are not fully acquainted with blockchain technology. They offer simpler processes for account setup, trading, and managing assets. To compete, DEXs and Layer 1/Layer 2 protocols need to invest in improving user interface and experience, making onboarding and navigation as seamless as possible.

- Speed and Scalability: High-frequency trading is more viable on CEXs due to faster transaction times and the ability to handle large transaction volumes. DEXs, especially those on Layer 1, often struggle with congestion and high gas fees. Layer 2 solutions and other scaling techniques should be implemented to enhance transaction speed and capacity on DEXs.

- Customer Support: CEXs usually have dedicated customer service teams, which provide immediate help when users encounter issues. DEXs, being decentralized, often lack this support. While it might be challenging to provide traditional customer support on DEXs, they can establish robust online communities and resources to assist users and address their queries and concerns promptly.

- Regulatory Compliance and Trust: CEXs are typically regulated and must comply with KYC/AML laws, which can inspire trust among certain user groups. While the anonymity of DEXs is attractive to some, it can also be a barrier for others. DEXs could work towards establishing a balance between user privacy and regulatory compliance to attract a broader user base.